Unlocking Wealth: Your Guide to Finding the Best Performing Stocks for 2025!

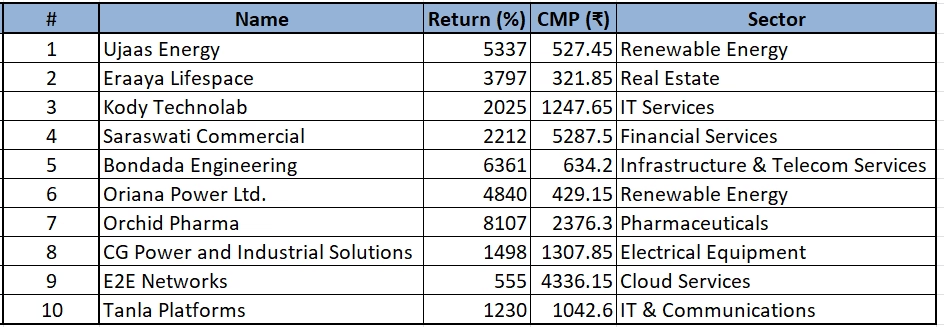

2024 has been a year of exceptional stock performances in the Indian equity markets. Several stocks have yielded extraordinary returns, primarily driven by strategic business initiatives, sectoral tailwinds, and improving macroeconomic conditions. Below is an in-depth analysis of the best-performing stocks, their current market prices (CMP), and their fundamental strengths, offering insights into their potential for continued growth.

1. Ujaas Energy

- Return: 5337%

- CMP: ₹527.45

- Sector: Renewable Energy

- Key Highlights:

- Transition to solar energy supported by favorable government policies.

- Turnaround in operational efficiency and project execution.

- Improved order book post-pandemic recovery.

- Fundamental Insights:

- Debt-to-equity ratio has improved significantly.

- Solar power penetration across industries provides long-term growth visibility.

- ROCE: 18.3%, indicating efficient capital utilization.

2. Eraaya Lifespace

- Return: 3797%

- CMP: ₹321.85

- Sector: Real Estate

- Key Highlights:

- Focused execution in affordable and mid-segment housing projects.

- Expansion into Tier 2 and Tier 3 cities with high demand.

- Fundamental Insights:

- Debt level well-managed, ensuring liquidity.

- High EPS growth of 36% in FY24, backed by rising property sales.

- Real estate demand surge under India’s “Housing for All” initiative.

3. Kody Technolab

- Return: 2025%

- CMP: ₹1,247.65

- Sector: IT Services

- Key Highlights:

- Specialization in automation, AI, and enterprise solutions.

- Growing presence in international markets.

- Fundamental Insights:

- High EBITDA margin of 42%, indicating a scalable business model.

- Expanding client portfolio and R&D investments position it for long-term growth.

4. Saraswati Commercial

- Return: 2212%

- CMP: ₹5,287.50

- Sector: Financial Services

- Key Highlights:

- Significant growth in wealth management services.

- Strong returns from proprietary investments.

- Fundamental Insights:

- ROE: 24.8%, indicating efficient profit reinvestment.

- Focus on diversifying into equity advisory and mutual fund distribution.

5. Bondada Engineering

- Return: 6361%

- CMP: ₹634.20

- Sector: Infrastructure & Telecom Services

- Key Highlights:

- Expansion in telecom tower and renewable energy infrastructure.

- Beneficiary of India’s infrastructure development push.

- Fundamental Insights:

- Debt-to-equity ratio of 0.4, ensuring financial stability.

- Revenue growth CAGR of 48% over the last 3 years.

6. Oriana Power Ltd.

- Return: 4840%

- CMP: ₹429.15

- Sector: Renewable Energy

- Key Highlights:

- Focused on rooftop and industrial solar installations.

- Increased adoption of solar technology across manufacturing sectors.

- Fundamental Insights:

- Consistent profit growth of 27% YoY.

- Low PE ratio of 15, making it an attractive value play.

7. Orchid Pharma

- Return: 8107%

- CMP: ₹2,376.30

- Sector: Pharmaceuticals

- Key Highlights:

- Post-restructuring, focus shifted to high-margin APIs and niche drug production.

- Strategic entry into international markets.

- Fundamental Insights:

- Improved gross margins of 60%.

- Strong pipeline of innovative drugs aimed at global markets.

8. CG Power and Industrial Solutions

- Return: 1498%

- CMP: ₹1,307.85

- Sector: Electrical Equipment

- Key Highlights:

- Restructuring under new management led to a sharp turnaround.

- Booming demand for automation and industrial electrification.

- Fundamental Insights:

- ROE of 30%, reflecting strong shareholder returns.

- Export-driven growth adds diversification benefits.

9. E2E Networks

- Return: 555%

- CMP: ₹4,336.15

- Sector: Cloud Services

- Key Highlights:

- Rapid adoption of AI-driven cloud solutions.

- Partnerships with top firms like Larsen & Toubro for tech services.

- Fundamental Insights:

- EBITDA margin of 51%, ensuring profitability.

- Rising institutional holdings (up 3% in FY24), signaling confidence in growth.

10. Tanla Platforms

- Return: 1230%

- CMP: ₹1,042.60

- Sector: IT & Communications

- Key Highlights:

- Pioneering cloud-based communication technologies.

- Increasing market share in global messaging platforms.

- Fundamental Insights:

- Strong free cash flow generation, enabling further innovation.

- Focused investments in AI integration for scalable solutions.

Summary :-

The listed stocks showcase impressive past 1Year performance driven by structural growth trends and operational excellence. However, advised to conduct a thorough analysis of valuations, growth prospects, and market risks. Diversifying investments and focusing on stocks with sound fundamentals and reasonable valuations can optimize returns.

How to Identify Potential Multi-Bagger Stocks for 2025

Investors are always on the lookout for multi-bagger stocks—companies that deliver returns several times their initial investment. The success of stocks like Ujaas Energy, Bondada Engineering, and others in 2024 showcases the power of strategic stock selection. But how do you identify such opportunities early? Here’s a step-by-step guide:

1. Focus on Emerging Sectors

- Why: Industries like renewable energy, artificial intelligence, cloud computing, and EVs are poised for exponential growth.

- How: Research government policies, global trends, and reports from industry analysts to spot emerging themes.

2. Study Financial Fundamentals

- Key Metrics to Watch:

- Revenue and Profit Growth: Look for companies with consistent double-digit growth.

- Low Debt: A debt-to-equity ratio below 0.5 is ideal.

- High ROCE and ROE: Ensure these are above 15%, indicating efficient capital use.

3. Evaluate Management Quality

- Why: Strong leadership drives long-term growth.

- How: Read annual reports, listen to earnings calls, and research the management team’s track record.

4. Look for Turnaround Stories

- Why: Companies undergoing restructuring often emerge stronger.

- How: Identify firms with improving profitability and strategic initiatives, like Orchid Pharma in 2024.

5. Analyze Market Trends and Sentiments

- Why: A company poised to benefit from sectoral tailwinds can outperform.

- How: Use tools like Google Trends, financial news platforms, and sentiment analysis to track market buzz.

6. Explore Small-Cap Gems

- Why: Small-cap companies often grow faster due to smaller bases.

- How: Use stock screeners to filter companies with low market caps but high revenue growth potential.

7. Stay Updated on IPOs

- Why: New-age businesses often enter the market through IPOs.

- How: Study DRHPs (Draft Red Herring Prospectus) to understand a company’s fundamentals before it gets listed.

8. Monitor Institutional Investments

- Why: Increased FII or DII holdings signal confidence in a company.

- How: Track changes in institutional holdings quarterly.

Conclusion

Finding multi-bagger stocks requires a mix of research, patience, and staying ahead of market trends. By focusing on fundamentals, emerging industries, and strategic opportunities, you can position yourself to uncover the next big winners for 2025.

**Always remember to diversify and consult with a financial advisor before investing.

Start researching today—you might just find the next multi-bagger!