When it comes to taxes, the rich play a completely different game—and it’s one they’re winning. You’ve probably heard stories about billionaires paying little to no income tax, while average earners shoulder a much heavier burden. But how is this possible? The truth lies in the way the wealthy structure their income and assets, and the strategies they use to avoid taxable events.

Let’s break it down step-by-step using the methods illustrated in the image above, along with how they repay borrowed money without triggering taxes. By the end, you’ll understand the fascinating, legally-backed strategies the rich use to minimize (or eliminate) taxes entirely.

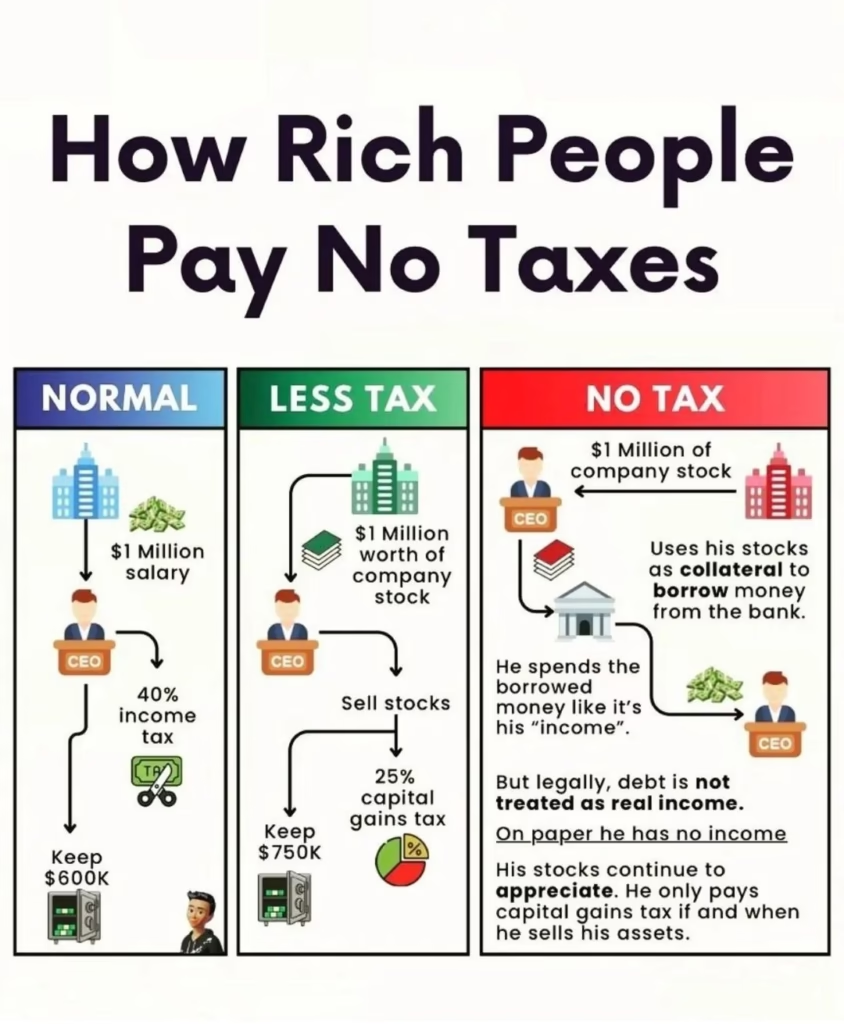

Three Scenarios: How Income is Taxed Differently

1. The Normal Worker: 40% Tax on Salary

For the average person, income comes from a salary. Let’s say you’re a CEO earning $1 million annually. A significant chunk—40%( income Taxes and Cess..)—goes straight to income tax. After taxes, you’re left with $600,000. This is the reality for most people who rely on wages.

Why is this the worst strategy for keeping wealth?

Income from salaries is taxed at the highest rates in most countries. It’s unavoidable, and there are few deductions available for salaried individuals.

2. The Smarter Rich: 25% Capital Gains Tax

Wealthy individuals often take their income in the form of stock options or equity rather than cash. For instance, a CEO could receive $1 million worth of company stock. When they sell those stocks, they only pay a 25% capital gains tax, which is significantly lower than the 40% income tax rate. This allows them to keep $750,000 instead of $600,000.

Why is this better?

The capital gains tax rate is lower than the income tax rate, making this strategy more tax-efficient. It also allows the wealthy to defer paying taxes until they decide to sell the stocks.

3. The Tax-Free Strategy: Borrowing Against Stock

Here’s where it gets really interesting. Instead of selling their stocks, the wealthiest individuals use their stock portfolio as collateral to borrow money from banks. Imagine a CEO has $1 million in company stock. Rather than sell it (which would trigger capital gains tax), they borrow against it.

The borrowed money isn’t considered “income” in the eyes of the law, so they owe no tax on it. They can then use this borrowed money to fund their lavish lifestyle—buying homes, cars, or whatever they need.

Why Borrowing Against Stock Works

1.Debt Isn’t Taxed:

When you borrow money, it’s not classified as income, so there’s no tax liability.

2.Stocks Continue to Appreciate:

While the CEO uses the loan money, their stock portfolio continues to grow in value. Over time, the increase in the stock’s worth far outweighs the cost of the loan interest.

3.Flexibility in Repayment:

Loans can often be refinanced, extended, or repaid strategically, as we’ll explain below.

How Do the Rich Repay Borrowed Money Without Paying Taxes?

Once you’ve borrowed against your assets, the question arises: how do you repay the loan without triggering taxes? Here are the strategies they use:

1. Sell Appreciated Assets Strategically

When repayment is due, they sell a small portion of their assets to cover the loan. For example, if their $1 million stock portfolio has appreciated to $1.5 million, they sell just enough to repay the loan. By selling in small amounts over time, they can minimize capital gains tax and avoid large taxable events.

2. Use Dividends or Investment Income

Rather than selling assets, the wealthy often use income from dividends or other passive investments to repay loans. Dividends are often taxed at lower rates than regular income, further reducing their tax liability.

3. Roll Over or Refinance Loans

A common tactic is simply rolling over the loan or refinancing it. If their stock portfolio has grown in value, they can borrow more against it, using the new loan to repay the old one. This delays repayment indefinitely while allowing their assets to continue appreciating.

4. Leverage the “Step-Up in Basis”

For those thinking long-term, estate planning plays a major role. If the individual passes away, their heirs inherit the stock with a stepped-up cost basis, which means the value of the stock is reset to its current market price. This eliminates any capital gains tax that would have been owed on the appreciation during their lifetime.

5. Maintain High Collateral Value

Because stock values generally rise over time, the wealthy can often avoid repaying the loan altogether. As long as their portfolio’s value increases, they have more than enough collateral to justify not liquidating assets.

Why This Strategy is Legal

All of this might sound unfair, but it’s completely legal. Tax codes around the world are designed to incentivize investment and wealth creation. Borrowing against assets takes advantage of these loopholes without violating any laws.

Governments typically focus on taxing earned income, not wealth. This creates a system where the richest individuals—whose wealth is tied up in stocks, real estate, and other appreciating assets—can minimize their tax liability while growing their net worth.

Why the Average Person Can’t Use This Strategy

For most people, these strategies are out of reach because they require significant wealth and assets. Banks only lend money against collateral, and the average person doesn’t have millions of dollars in stocks to use as leverage.

However, understanding these methods can help everyday investors think differently about wealth-building. For instance, investing in assets that appreciate over time—like stocks or real estate—can help you take advantage of lower capital gains taxes.

Conclusion: What Can We Learn?

The rich don’t “cheat” the system—they master it. By avoiding high-tax income streams like salaries and using strategies like borrowing against assets, they legally minimize taxes while growing their wealth exponentially.

While these methods aren’t accessible to everyone, they highlight the importance of investing in appreciating assets and planning your finances strategically. If you want to build long-term wealth, it’s time to start thinking more like the wealthy.

Your path to financial freedom starts with understanding the rules of the game—and, just like the rich, learning how to win.