Why NPS is the Best Long-Term Investment for Retirement Security

Imagine an investment that offers 20-40% returns—sounds unbelievable, right? But NPS (National Pension System) has delivered exceptional returns over the years.

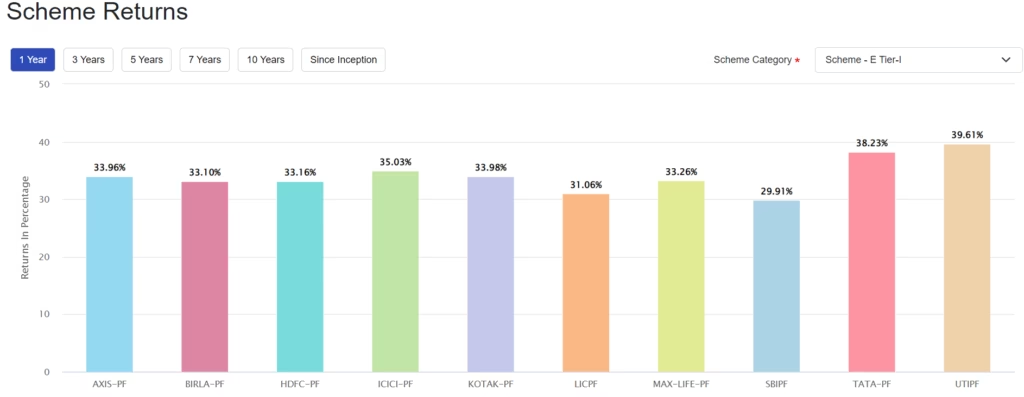

If you’re in the 30% tax bracket, investing in NPS means instant 30% tax savings. Plus, looking at past performance, NPS equity (E) funds have delivered returns between 10-38%, with many funds crossing 30% in the last year alone.

It’s not just an investment; it’s smart tax planning and a secure retirement plan in one!

Government Push & New Flexibilities in NPS

The government is actively promoting NPS as a social security tool, granting it EEE (Exempt-Exempt-Exempt) tax status and allowing partial withdrawals (with conditions) after just 3 years. This makes it even more attractive—especially for young investors.

Investment Limits & Tax Benefits

To get full tax benefits, you should invest:

✅ Government employees: Up to 14% of basic salary

✅ Corporate sector employees: Up to 10% of basic salary

✅ Additional ₹50,000 per year under Section 80CCD(1B)

This ensures maximum tax savings and long-term wealth creation.

💡 While you can invest more in Tier II NPS, I don’t recommend it—mutual funds often provide similar or better tax-adjusted returns with greater flexibility.

Today, 10 fund managers manage NPS investments, offering diverse choices.

🔗 For a detailed NPS return analysis, visit: Returns under NPS | NATIONAL PENSION SYSTEM TRUST

Extra Tax Benefit, Extra Happiness!

NPS = Tax Saving + Retirement Planning + Market-Linked Growth

Why Corporates Prefer NPS for Employees

✅ No administrative burden: Employer only facilitates salary deduction.

✅ No additional corporate cost: Unlike superannuation funds, NPS has zero extra admin costs.

✅ 100% employee control: Employees manage their NPS account independently.

✅ Runs parallel to other retirement plans: NPS co-exists with EPF, gratuity, and other pension schemes.

✅ No need to create a trust: A single NPS Trust monitors fund managers.

✅ Superannuation fund transfers allowed: PFRDA permits superannuation fund transfers into NPS (subject to ITD approval).

✅ Employer’s contribution is tax-deductible: It qualifies as a business expense under Section 36 (1) (IVA).

How NPS Works: A Step Towards Financial Freedom

1️⃣ Build a Retirement Corpus

NPS encourages disciplined savings to create a retirement fund, which is later used to purchase an annuity (pension).

2️⃣ Retirement Income Security

The government designed NPS to ensure sustainable retirement income for all.

3️⃣ Higher Market-Linked Returns

Your contributions are invested in equity and debt markets, generating inflation-beating returns over time.

4️⃣ Assured Monthly Pension

Upon retirement, NPS ensures a steady income stream through annuities, providing financial security in old age.

6 Key Features That Make NPS Stand Out

✅ Triple Tax Benefit (EEE Status) – Tax-free investment, growth, and withdrawal

✅ Safe & Regulated – Governed by PFRDA for transparency

✅ Low Cost – One of the cheapest investment options available

✅ Portable – Stays with you across jobs & locations

✅ Flexible – Choose asset allocation & switch funds

✅ Online Access – Manage & track your investments anytime, anywhere

💻 Complete control at your fingertips!

Withdrawal & Exit Rules in NPS

Retirement Withdrawal (60 Years & Above)

✅ 60% lump sum withdrawal (Tax-free)

✅ 40% annuity purchase for pension

✅ If corpus ≤ ₹5 Lakh, full withdrawal is permitted tax-free

Early Exit (Before 60 Years of Age)

✅ Only 20% can be withdrawn (Tax-free)

✅ 80% must be used to buy an annuity

✅ If corpus ≤ ₹2.5 Lakh, full withdrawal is allowed tax-free

✅ Early exit is only allowed after 10 years of contribution

In Case of Death of Subscriber

✅ Entire NPS corpus is transferred tax-free to the nominee or legal heirs

Partial Withdrawal Flexibility

The PFRDA has relaxed partial withdrawal norms, allowing up to 3 withdrawals after 3 years of investment.

📌 Withdraw up to 25% (excluding employer contributions & interest) for:

✔️ Higher education of self/children

✔️ Marriage expenses of children

✔️ Treatment of critical illnesses (self/spouse/children)

✔️ Purchase/construction of a residential property

Deferment Option: More Flexibility at Retirement

Upon retirement, employees can opt to:

✔️ Defer annuity investment for up to 3 years

✔️ Defer corpus withdrawal until 75 years of age

✔️ Withdraw in installments (max 10 installments)

✔️ Continue investing in NPS until 75 years

💡 The longer you stay invested, the bigger your retirement corpus!

Final Thoughts: Is NPS Worth It?

✅ Triple tax benefits (EEE status)

✅ Market-linked returns outperforming traditional FDs & PPF

✅ Low-cost & flexible retirement planning

✅ Government-backed security

✅ Partial withdrawal & exit flexibility

🚀 Start investing in NPS today & secure your financial future! 🚀

Frequently Asked Questions (FAQ) on National Pension System (NPS)

1. What is NPS?

NPS (National Pension System) is a government-backed pension scheme designed to provide financial security after retirement. It is a market-linked and low-cost retirement savings plan regulated by the Pension Fund Regulatory and Development Authority (PFRDA).

2. Who can invest in NPS?

✅ Indian citizens (both residents and NRIs) between 18 to 70 years can invest.

✅ Salaried employees, self-employed individuals, and government employees are eligible.

3. How does NPS work?

🔹 You invest regularly in NPS Tier I (mandatory) and Tier II (optional).

🔹 Your funds are invested in equity, corporate bonds, and government securities, managed by 10 fund managers.

🔹 Upon retirement, you can withdraw a portion of the corpus tax-free and the rest is used to buy an annuity for a monthly pension.

4. What are the tax benefits of investing in NPS?

✅ Up to ₹1.5 lakh deduction under Section 80CCD(1) (Part of 80C).

✅ Additional ₹50,000 deduction under Section 80CCD(1B) (exclusive NPS benefit).

✅ Employer’s contribution (up to 10-14% of basic salary) is tax-deductible under Section 80CCD(2).

✅ EEE (Exempt-Exempt-Exempt) tax status ensures no tax on investment, growth, and withdrawal (with conditions).

5. What are NPS Tier I and Tier II accounts?

| Feature | NPS Tier I (Mandatory) | NPS Tier II (Optional) |

|---|---|---|

| Tax Benefits | ✅ Yes (80CCD & 80CCD(1B)) | ❌ No |

| Minimum Contribution | ₹500 per contribution | ₹250 per contribution |

| Withdrawal | Restricted (after retirement) | Anytime |

| Lock-in Period | Until 60 years (exceptions apply) | No lock-in |

| Purpose | Retirement Planning | Flexible Savings |

💡 Tier II is like a savings account, but lacks tax benefits. Mutual funds are a better alternative for flexible investments.

6. What is the return rate on NPS investments?

NPS does not offer fixed returns as it is market-linked. However, historical returns show:

📈 Equity Funds (E): 10-38% returns (last year saw over 30% in most funds).

📈 Corporate Bonds (C): 9-12% returns.

📈 Government Securities (G): 7-10% returns.

💡 Past performance suggests that long-term investors can get double-digit returns.

7. Can I change my fund manager in NPS?

✅ Yes, NPS allows fund manager switching once per year.

✅ You can also change the asset allocation (equity, debt, bonds) once per year.

8. How can I withdraw money from NPS?

| Withdrawal Type | Conditions |

|---|---|

| Retirement Withdrawal (60+ Years) | ✅ 60% tax-free lump sum + 40% used to buy an annuity |

| Early Exit (Before 60 Years) | ✅ Only 20% tax-free, 80% must be invested in an annuity |

| Death of Subscriber | ✅ 100% corpus is given tax-free to the nominee/legal heirs |

| Partial Withdrawal | ✅ Allowed 3 times after 3 years, up to 25% for specific needs |

9. What are the permitted reasons for partial withdrawal?

✔️ Higher education of self or children

✔️ Marriage of children

✔️ Treatment of critical illnesses (self/spouse/children)

✔️ Purchase/construction of a first residential property

10. Can I defer withdrawal or continue investing in NPS after retirement?

✅ Yes, after retirement at 60, you can:

✔️ Defer annuity investment for up to 3 years

✔️ Defer corpus withdrawal till 75 years

✔️ Continue investing in NPS till 75 years

💡 This ensures your money continues growing!

11. What happens if I don’t contribute regularly?

📌 If no contribution is made for 1 year, the account becomes inactive.

📌 To reactivate, you must pay a minimum contribution of ₹500.

12. How is NPS different from EPF & PPF?

| Feature | NPS | EPF | PPF |

|---|---|---|---|

| Tax Benefit | ✅ Yes (EEE) | ✅ Yes (EEE) | ✅ Yes (EEE) |

| Returns | ✅ Market-linked (8-15%) | ✅ Fixed (8-9%) | ✅ Fixed (7-8%) |

| Withdrawal | ❌ Restricted (60% lump sum, 40% annuity) | ✅ Allowed after 5 years | ✅ Allowed after 15 years |

| Investment Limit | ❌ No Limit | ❌ Up to 12% of salary | ✅ ₹1.5 Lakh per year |

| Best for | Long-term retirement income | Employee pension savings | Safe government-backed savings |

💡 NPS is ideal for higher market-linked returns & tax benefits.

13. How can I start investing in NPS?

📌 Open an NPS account online via eNPS portal or through banks, post offices, or POPs (Point of Presence).

📌 Provide Aadhaar, PAN, and bank details.

📌 Choose your fund manager and investment mix (equity, bonds, govt securities).

14. Can NRIs invest in NPS?

✅ Yes, NRIs can invest in NPS but must maintain an Indian bank account & PAN card.

15. What is the minimum investment required for NPS?

| Account Type | Minimum Contribution Per Year |

|---|---|

| Tier I | ₹1,000 |

| Tier II | No minimum requirement |

16. Can I take a loan against my NPS investment?

❌ No, loans against NPS are not allowed. However, partial withdrawals are permitted for specific needs.

17. What happens if I switch jobs?

📌 NPS is portable—you can continue investing without any impact.

📌 Simply update employer details in the NPS account.

18. Who are the fund managers for NPS?

Currently, 10 pension fund managers manage NPS investments:

1️⃣ SBI Pension Fund

2️⃣ UTI Retirement Solutions

3️⃣ LIC Pension Fund

4️⃣ ICICI Prudential Pension Fund

5️⃣ HDFC Pension Fund

6️⃣ Kotak Pension Fund

7️⃣ Aditya Birla Sun Life Pension Fund

8️⃣ Tata Pension Fund

9️⃣ Max Life Pension Fund

🔟 Axis Pension Fund

19. Is NPS better than a mutual fund for retirement?

✅ NPS is tax-efficient & government-backed but has withdrawal restrictions.

✅ Mutual funds offer more flexibility but don’t provide the same tax benefits.

💡 For retirement planning, a mix of NPS & mutual funds is a great strategy!

20. Is NPS a good investment in 2025?

✅ YES! With triple tax benefits, strong returns, and government backing, NPS is an excellent long-term investment for a secure retirement.